Tax-exemption for nonprofits is a privilege — not a right — that must be earned. All nonprofits, secular or religious, should be held to the same IRS rules and oversight that hold them accountable to the taxpayers subsidizing their tax benefits.

Related News

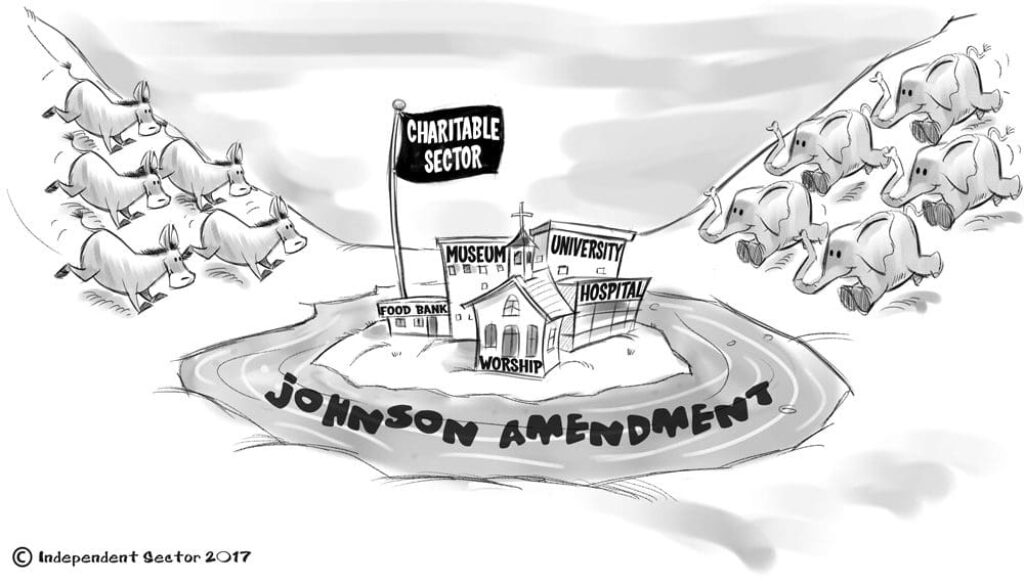

SCA Let’s it be Known: The Johnson Amendment MUST be Enforced

The IRS has officially destroyed the Johnson Amendment as we know it. The creation of the Johnson Amendment happened over seven decades ago because Congress knew religious places of worship should not…

How Liberty University Built a Billion-Dollar Empire Online

April 18, 2018

When Is a Church Not a Church?

April 17, 2018

Controversy Swirls as Lawmakers Eye Campaign Finance Changes

March 22, 2018Related Actions