Tax-exemption for nonprofits is a privilege — not a right — that must be earned. All nonprofits, secular or religious, should be held to the same IRS rules and oversight that hold them accountable to the taxpayers subsidizing their tax benefits.

Related News

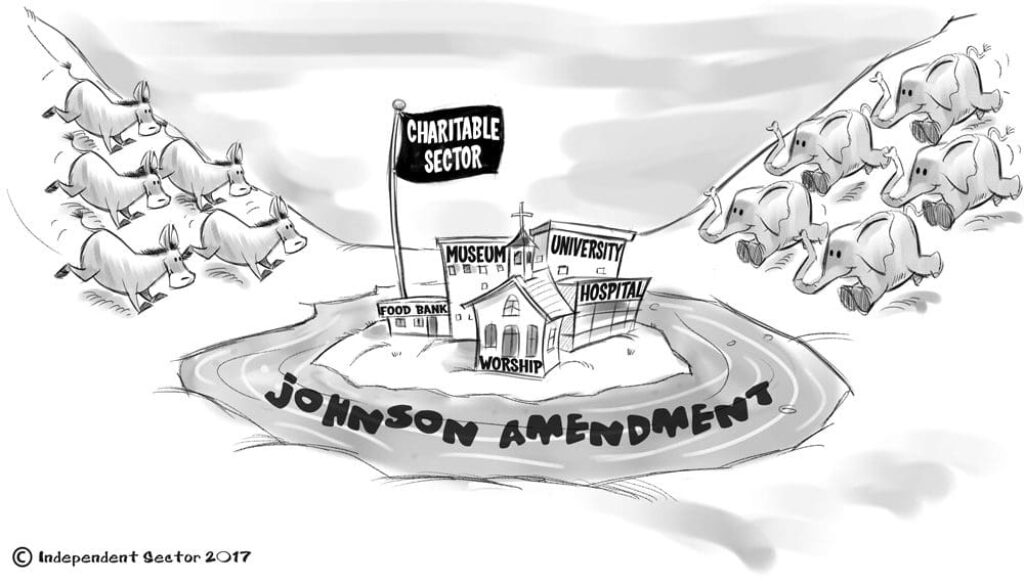

Heretic on the Hill: Bill Would Formalize Politics in Churches

At the Secular Coalition we try to stay in our lane, and our lane is not trade and tariffs. However, when someone with a high school understanding of trade deficits blows up $8 trillion in market valu…

Why Are These Christian Non-Profits Telling the IRS They’re Churches?

February 22, 2018

Trump Signs Budget Deal Giving Taxpayer Money To Churches

February 13, 2018Related Actions