Johnson Amendment

All nonprofits should be transparent and held accountable to American taxpayers. Religious organizations should be held to the same tax filing standards as all other charities.

Tax-exempt nonprofits are an integral part of many communities, often providing public services that improve or even save lives. However, non-profit tax exemption is not a right, it is a privilege that must be earned.

Nonprofits with 501(c)(3) status not only do not pay federal income taxes, they also can collect tax-deductible donations. This privilege comes with certain responsibilities, including a commitment to transparency, so that the American taxpayers who are subsidizing nonprofits’ tax-exempt status can be assured that they are genuinely serving the public, not an ulterior agenda, and focusing on enriching the community, not themselves.

The Form 990

One of the most important obligations a nonprofit has to its donors and to taxpayers is to file the 990 tax form, which discloses a nonprofit’s sources of income, expenditures, and governance structure. Unfortunately, religious nonprofits are exempt from filing the 990 and as a result, are completely unaccountable to taxpayers and their parishioners.

The Johnson Amendment

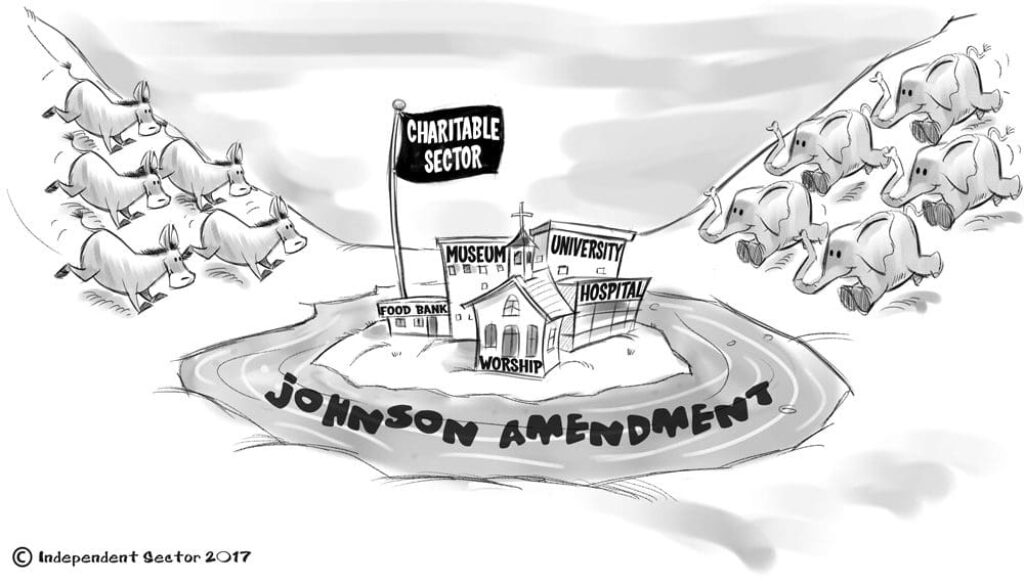

Under a provision of the tax code known as the Johnson Amendment, all 501(c)3 nonprofits, including churches, are prohibited from endorsing political candidates. This ensures that their resources go toward helping those in need and prevents church dollars from becoming the equivalent of theological super PACs. In recent years, some organizations on the religious right have actively encouraged churches to openly violate this prohibition on endorsing political candidates including the Alliance Defending Freedom which organizes “Pulpit Freedom Sunday” every year.

The prohibition on church politicking is crucial for holding churches accountable to the responsibility that comes with the privilege of nonprofit status. Society has chosen to grant tax exempt status to those organizations that promote the public welfare, not partisan politics.

Thanks to the unprecedented influence of the Religious Right on the Trump Administration, President Trump has vowed to “totally destroy” the Johnson Amendment and Members of Congress have introduced several bills that would either weaken or completely repeal the law.

The Secular Coalition for America calls for religious nonprofits to be held accountable to the same standards as their secular counterparts. Religious affiliation should not elevate any nonprofit above the law.

Tax-Exemption is a Choice

Applying or and benefitting from a 501(c)(3) tax-exempt status is an organization’s choice. Therefore any organization that does not wish to be subjected to government oversight in exchange for government benefits may choose to forego this option. Non-profits, including houses of worship, who feel it is an integral part of their mission to endorse or oppose political candidates, have other nonprofit designations to choose from, such as a 501(c)(4), which may not collect tax-exempt donations.

The Secular Coalition for America supports the separation of religion and government, including both religious interference in government and government interference in religion. However, given that houses of worship are not required to designate themselves as a 501(c)(3) nonprofit, requiring those that do to be held to equal standards regarding transparency and fairness does not infringe upon their free exercise of religion.

Related News

Heretic on the Hill: Bill Would Formalize Politics in Churches

At the Secular Coalition we try to stay in our lane, and our lane is not trade and tariffs. However, when someone with a high school understanding of trade deficits blows up $8 trillion in market valu…

Heretic on the Hill: Phoning it in on Virtual Lobby Day

June 25, 2022

SCOTUS Opinion: Carson v. Makin

June 21, 2022

Heretic on the Hill: Spooky Season for Secularism

October 31, 2021Related Actions